The Canadian investment landscape is experiencing a digital revolution as robo-advisors and automated investment platforms capture unprecedented market share, fundamentally changing how Canadians approach wealth building and portfolio management.

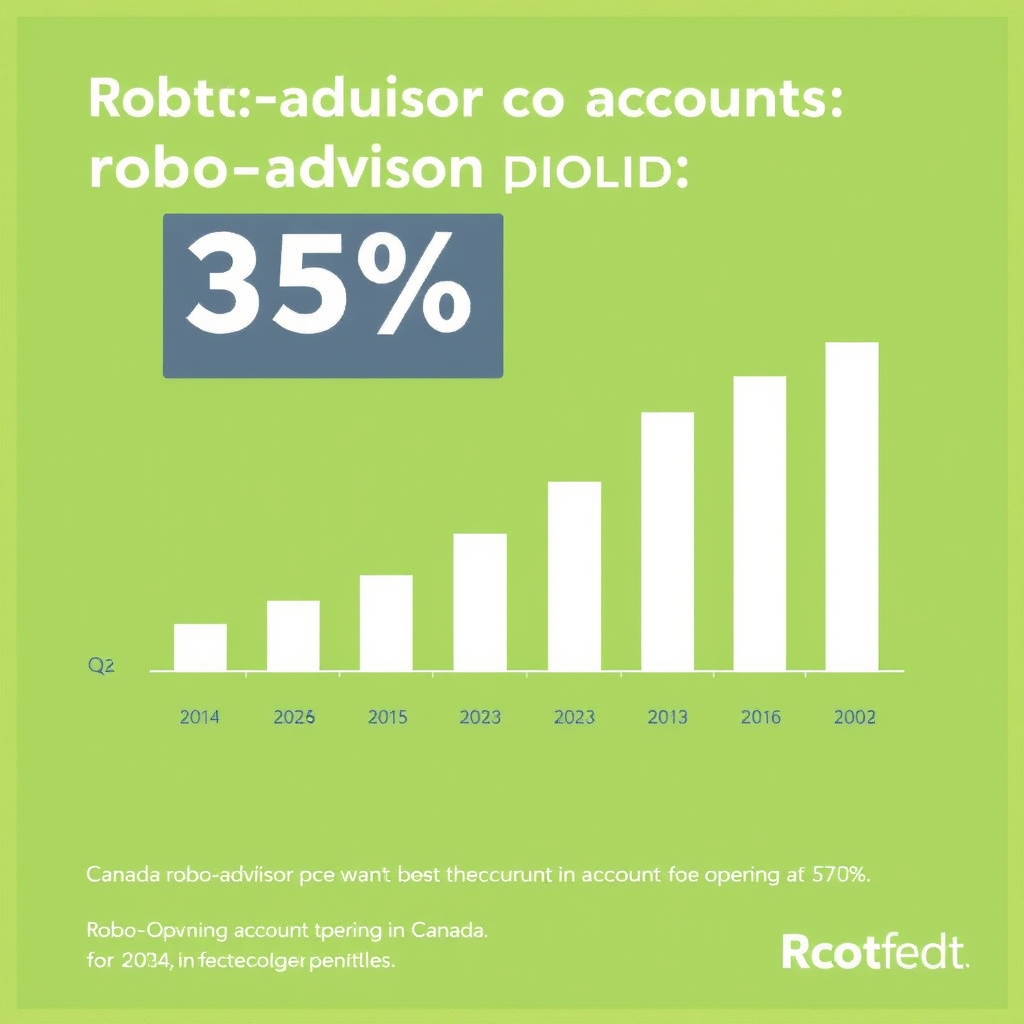

Record-Breaking Growth in Q3 2024

Digital investment platforms across Canada reported a remarkable 35% surge in new account openings during the third quarter of 2024, marking the highest quarterly growth rate in the industry's history. This dramatic increase reflects a broader shift toward technology-driven investment solutions as Canadians seek more accessible and cost-effective ways to grow their wealth.

The growth is particularly pronounced among younger investors, with millennials and Gen Z Canadians leading the charge in adopting automated portfolio management services. Many are starting with modest amounts, exploring how to invest 250 dollars in Canada through these user-friendly platforms that offer low minimum deposits and transparent fee structures.

Technology Meets Investment Strategy

Modern robo-advisors are leveraging artificial intelligence and machine learning algorithms to provide sophisticated portfolio management that was once exclusive to high-net-worth individuals. These platforms automatically rebalance portfolios, optimize tax efficiency, and adjust risk levels based on market conditions and individual investor profiles.

For Canadians wondering about the best way to grow $250 fast Canada, these platforms offer diversified ETF portfolios that can be started with minimal capital. The automated nature of these services eliminates the need for extensive investment knowledge while providing professional-grade portfolio management.

Impact on Traditional Wealth Management

The rise of robo-advisors is forcing traditional wealth management firms to adapt their service models. Many established financial institutions are now launching their own digital investment platforms or partnering with fintech companies to remain competitive in this rapidly evolving market.

Key Advantages of Digital Platforms

- Lower fees and transparent pricing

- 24/7 account access and monitoring

- Automated rebalancing and optimization

- Low minimum investment requirements

- Tax-loss harvesting capabilities

Market Trends and Future Outlook

Industry analysts predict that the trend toward digital investment solutions will continue accelerating, particularly as more Canadians become comfortable with technology-based financial services. The convenience of managing investments through mobile apps and the ability to start with small amounts appeals to a broad demographic seeking low budget investments with high returns.

The integration of educational resources within these platforms is also contributing to their popularity. Many robo-advisors now offer comprehensive learning modules that help users understand investment principles, making them attractive to novice investors who want to build their financial literacy while growing their wealth.

Popular Investment Options for Small Capital

Canadian investors with limited capital are increasingly exploring:

- ETF portfolios - Diversified exposure to Canadian and international markets

- High yield savings alternatives - Comparing traditional savings with investment returns

- Fractional share investing - Access to expensive stocks with small amounts

- Automated dollar-cost averaging - Regular small investments to reduce market timing risk

Regulatory Environment and Consumer Protection

Canadian financial regulators have been proactive in establishing frameworks for robo-advisor operations, ensuring that these platforms meet the same fiduciary standards as traditional investment advisors. This regulatory oversight provides investors with confidence in the security and legitimacy of digital investment platforms.

The Canadian Securities Administrators (CSA) continues to monitor the robo-advisor space, implementing guidelines that protect consumers while fostering innovation in the financial technology sector. This balanced approach has contributed to Canada's position as a leader in fintech adoption.

Looking Ahead: The Future of Canadian Investing

As we move into 2025, the convergence of artificial intelligence, blockchain technology, and traditional investment principles is creating new opportunities for Canadian investors. The democratization of investment management through robo-advisors is just the beginning of a broader transformation in how Canadians build and manage wealth.

For those exploring investing in ETFs with little money Canada or seeking passive income with small amounts, the expanding ecosystem of digital investment platforms offers unprecedented access to sophisticated investment strategies that were once available only to institutional investors.

The success of robo-advisors in Canada demonstrates that technology can effectively bridge the gap between professional investment management and individual investor needs, creating a more inclusive and accessible financial landscape for all Canadians.

This analysis is based on industry reports and market data from Q3 2024. Investment decisions should always be made in consultation with qualified financial professionals and based on individual circumstances and risk tolerance.